September 18, 2024

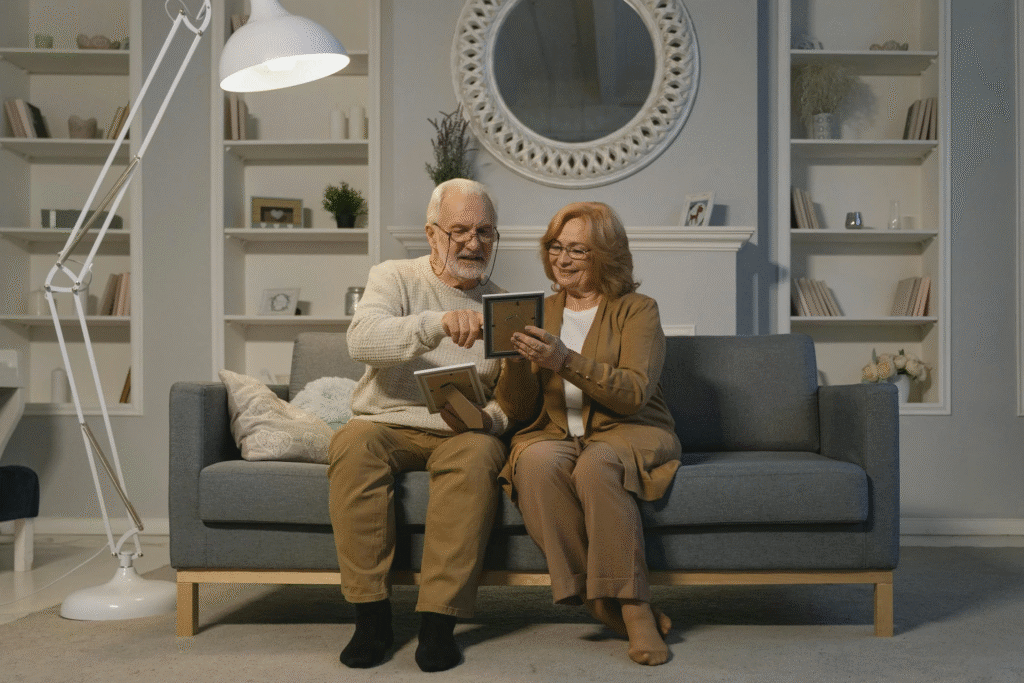

New Jersey Employers Required to Offer Retirement Savings Plans

New Jersey Employers Required to Offer Retirement Savings Plans

Starting this Fall 2024, New Jersey employers must offer a retirement savings plan to their employees if the employer:

- is engaged in any business or other enterprise in New Jersey, whether for profit or not for profit,

- employed at least 25 people in New Jersey in the previous calendar year,

- has been in business at least two years, and

- has not offered a qualified retirement plan (such as a 401(k) or 403(b) plan) to its employees in the previous two years.

How Can Employers Comply?

Employers must either offer a retirement plan or automatically enroll their employees into a state-administered retirement savings program. New Jersey opened its state-administered retirement savings program, called Retire Ready NJ, in June 2024.

Employers who have their own retirement programs must submit written notification to the New Jersey Secure Choice Board to be exempt from the Retire Ready NJ program.

What is Retire Ready NJ?

Retire Ready NJ helps employees save for retirement in a Roth or Traditional IRA account through automatic payroll deductions. There is no cost for employers to participate.

Employees can choose not to participate in a workplace retirement savings program.

What Are the Deadlines?

Employers who have 40 or more employees must implement a retirement plan by September 15, 2024. Employers who fail to comply by June 15, 2025, may be subject to penalties.

Employers who have 25-39 employees must implement a retirement plan by November 15, 2024. Employers who fail to comply by August 15, 2025, may be subject to penalties.

Why Now?

The New Jersey Secure Choice Act was signed into law in March 2019. The Act required New Jersey to develop a state-sponsored retirement plan. After many delays, the state-sponsored plan, Retire Ready NJ, opened on June 30, 2024.

What About New York Employers?

New York State has a similar law that applies to employers with 10 or more employees and was supposed to go into effect in 2022. However, New York State employers are not yet required to comply with the law because NYS has not yet opened its own state-sponsored retirement plan.

More information about Retire Ready NJ is available here:

https://nj.gov/treasury/securechoiceprogram/board-info.shtml

If you have questions or concerns about the New Jersey Secure Choice Savings Program, please contact Chaim Book at CBook@booklawllp.com, Sheryl Galler at SGaller@booklawllp.com, or Nadav Zamir at NZamir@booklawllp.com.